Contents

- What is M-pesa?

- Advantages of having Lipa na M-pesa to a business

- Lipa na M-pesa Account requirements

- For a limited company to get a paybill number the following are the requirements

- Lipa na M-pesa Account requirements for Sole proprietor

- Lipa Na M-pesa Charges

- Steps on how to check Lipa Na M-pesa Charges

- Difference between Lipa na M-pesa – Pay bill and Buy Goods and Services

- List of commonly used Mpesa pay bill numbers

- How to check your M-pesa balance

- How to Buy Airtime through M-PESA

- How to Change your M-PESA PIN

- how to deposit money in my M-pesa Account

- How to Withdraw Cash from M-Pesa

- How to Register for M-PESA

- Requirements to register for M-PESA as a Customer

- How to send money on M-pesa

Lipa Na M-pesa Charges: The word Lipa na M-pesa literally means (Pay using M-pesa). Lipa na M-pesa charges are the fee charged when you pay using the platform. Since the inception of Lipa na M-pesa, more than 15 billion Kenyan shillings is transacted daily.

Lipa na M-pesa is one of the services under M-pesa that enables its user to pay for different goods and services either by choosing to pay under pay bill number or till number. Lipa na M-pesa charges vary depending on the service and amount of money being transacted. The maximum daily transaction in Lipa na M-pesa is Kshs 140,000.

The maximum capacity per transaction is Kshs 70,000/=. In order to understand Lipa na M-pesa charges fully it’s good to know what is M-pesa.

What is M-pesa?

M-pesa is a mobile money transfer service that was launched in 2007. It’s largely used in Kenya, where it had over nineteen million users by end of 2016. Some of the other places where you will find M-pesa users include Africa, Asia and Europe. Services offered include sending money, cash withdrawal, buying airtime, loan applications and Lipa na M-pesa.

Worldwide the number of M-pesa users had risen to approximately over 25 million by end of 2016. The reason why M-pesa is common in some of these areas is because it has abled many people to transact even without the need of bank accounts.

Advantages of having Lipa na M-pesa to a business

Businesses that enable their customer to have a payment option of Lipa na M-pesa are considered more customer friendly. This is because they make it easy to pay regardless of the location. With the additional options of accessing your bank account from you M-pesa it’s even easier to pay for anything without having to move.

Risks associated with handling cash are also reduced as less liquid cash is handled. Theft and unnecessary expenditures are also reduced as result. In general, business efficiency is improved which results to better customer satisfaction and better sales. The only limiting factor with Lipa na M-pesa is that one can only transact upto kshs 140,000 per day. For goods and services require larger amount of money they may need additional payment methods.

Lipa na M-pesa Account requirements

Lipa na M-pesa requirements varies depending if you are the customer or the business.

In order to enjoy the benefits of Lipa na M-pesa every customer should have their M-pesa activated. The activation can be done by creating M-pesa PIN and submitting the Identification Card (ID number) and date of birth.

For businesses to have the platform of Lipa na M-pesa it will require to have a paybill number or till number from Safaricom authorized dealers or from Safaricom shops.

The following are the Lipa na M-pesa requirements for limited company and Sole proprietor

Lipa na M-pesa Account requirements for registered companies

For a limited company to get a paybill number the following are the requirements

1. Application form that is duly filled and signed including the terms and conditions

2. A copy of tariff guide already signed

3. Certificate of incorporation that is clearly stamped using company stamp

4. A sealed original board resolution that is sealed or stamped on company’s letter head. At least signed by two directors within the 30 days of application.

The resolution should include:

a. Approval by the board to open a Lipa na M-pesa paybill account and to transact business b. Approval of signatories and their identification

c. Bank account details

d. Approval of a Safaricom Number that will be used to start fund withdrawal on behalf of the company although this is not mandatory

5. Directors and company’s KRA pin certificate

6. Valid copy of CR12 ( Validity period of 30 days)/or Annual Returns to the register of companies with filling receipt

7. Latest copy of Utility Bill or Business Photo to illustrate existence of the Business

8. Identification Documents of the company’s representative making the application. Eg ID copy.

9. Letter from Bank confirming Bank account details or any other document that may approve the validity of the bank account

Lipa na M-pesa Account requirements for Sole proprietor

For a Sole proprietor to get a paybill number the following are the requirements

1. Application form that is duly filled and signed including the terms and conditions

2. A copy of tariff guide already signed

3. Copy of Business Permit from respective counties

4. The business owner Individual KRA Pin although it is not Mandatory

5. Identification Documents of the person making the application. Eg ID copy.

6. Latest copy of Utility Bill or Business Photo to illustrate existence of the Business

7. Letter from Bank confirming Bank account details or any other document that may approve the validity of the bank account

For Lipa na M-pesa requirements for Non-Governmental Organization (NGO’s) Churches, Co-operatives societies/SACCOS, Parastatals Schools, Government ministries, Counties, Financials institutions visit the nearest Safaricom shop or visit Safaricom website for more details on the requirements to get the paybill numbers

Lipa Na M-pesa Charges

Lipa na M-pesa charges are incurred once you pay for goods and services. To do this go to your sim tool menu select M-pesa, Choose Lipa na M-pesa enter the required information. After finishing the transaction both customer and seller will get a confirmation message.

Beginning Mid February 2017 Lipa na M-pesa charges starts being disclosed to customer after Competition Authority of Kenya (CAK) directives. In addition customers are also being informed of Lipa na M-pesa charges they are about to incur before confirming any payment transaction.

Steps on how to check Lipa Na M-pesa Charges

Before making any Lipa na M-pesa transactions it’s good to know the charges that will be incurred. To check Lipa na M-pesa charges follow the following steps

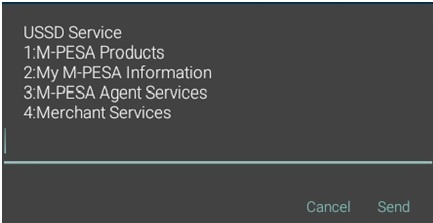

1. Dial *234# to get below pop up message

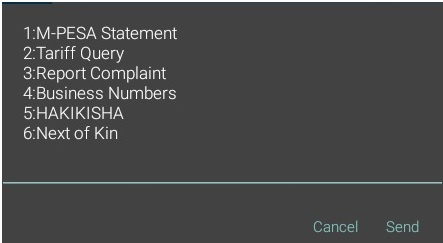

2. Select 2 for Tariff Query

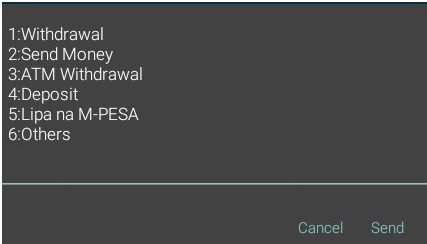

3. Chose 5 for Lipa na M-PESA

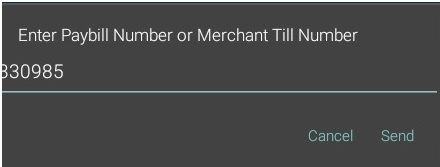

4. Enter Paybill Number or Business Till Number

5. Type the amount being charged by the business and send. You will get an SMS notifying you of how much Lipa na M-pesa charges will be incurred.

Difference between Lipa na M-pesa – Pay bill and Buy Goods and Services

To pay under buy goods and services you only need the till number displayed by the business from where you are purchasing the goods or services. You actually need no business relationship with any business in order to use their till number. On the other hand paybill will require you to have the business number and the account number you are paying for. For instance if you are paying for your post pay KPLC electricity bill, KPLC Post pay business account number is 888888, the Account number will be your KPLC account number.

Some of the of the bills you can pay using Lipa na M-pesa PayBill Service include

-Some Utility bills – water bills, Electricity bills, telephone bills, etc

-School fees payments

-SACCO contributions

-Bank deposits

– NSSF & NHIF

List of commonly used Mpesa pay bill numbers

KPLC Post pay Paybill number 888888

KPLC Pre-paid/Token Paybill number 888880

Nairobi Water & Sewerage Co. Ltd Paybill number 444400

Safaricom postpay Paybill number 200200

Kiambu Water & Sewerage Company Ltd Paybill number 885100

Nakuru Water and Sanitation Co Paybill number 111444

GO TV Paybill number 423655

NHIF Paybill number 200222

NSSF Paybill number 333300

Startimes Limited Paybill number 585858

The Nairobi Hospital Paybill number 879700

ZUKU Satellite TV Paybill number 320323

How to check your M-pesa balance

Steps on how to check your M-pesa balance. Sometimes you would like to send money, purchase airtime or do shopping and would like to know your M-pesa Balance.

Checking your M-PESA Balance

Check your current M-PESA balance status free of charge.

NB: Your balance is also shown at the end of every SMS each time you do an M-PESA transaction.

1. Go to Safaricom Menu,

2. Select “M-pesa Menu”

3. Click on “My Account”

4. Next Click “Check Balance”

5. Enter your secret PIN

6. Wait for SMS confirmation message with your balance

How to Buy Airtime through M-PESA

Article on how to Buy Airtime through M-PESA. M-PESA gives you the ease of topping up wherever you are whenever you want without having to look for a physical shop.

To top up via M-PESA:

- Go to Safaricom Menu,

- Select “M-pesa Menu”

- Go to ‘Buy airtime’

- Enter mobile phone number of the phone you are buying airtime for.

- Enter amount of airtime you wish to buy.

- Enter your M-PESA PIN and then confirm the details. The confirmation message will read “Buy airtime 0722 123456 KSh 100”, complete transaction by pressing OK.

- You will receive a confirmation SMS from M-PESA.

How to Change your M-PESA PIN

How to Change your M-PESA PIN. For security reasons, you can change your PIN at any time at absolutely no FEE!

How to Change your M-PESA PIN

- Go to Safaricom Menu

- Select M-PESA menu

- Select “My Account”.

- Select “Change PIN”.

- Enter old PIN press OK.

- Enter new PIN and confirm it.

- Wait for the confirmation.

how to deposit money in my M-pesa Account

Article on: how to deposit money in my M-pesa Account. To put money into your M-PESA account you will need to:

- Go to an authorized M-PESA agent with your phone and original ID.

- Inform the agent how much you wish to deposit.

- They will use their agent phone to send you e-money in exchange for cash.

- You and your agent will receive an SMS from M-PESA confirming the transaction.

To send money through M-PESA you must first deposit money into your own account. You cannot deposit money directly into another person’s M-PESA account.

How to Withdraw Cash from M-Pesa

Steps on how How to Withdraw Cash from M-Pesa, If you are a Registered M-PESA Customer, Non-Registered Customer,and ATMS

If you are a Registered M-PESA Customer

• Go to an M-PESA Agent and:

• Confirm the agent has sufficient funds for your transaction.

• Give your phone number and show your original ID.

• Go to your M-PESA menu, select ‘Withdraw cash’.

• Enter the Agent number, the amount you wish to withdraw and your PIN.

• You will receive a screen with the above transaction details. A pop up with the name of the agent will appear on the screen. Remember to confirm the name of the agent. To stop a wrong transaction, type 1 and press send within 15 seconds.

• You and your agent will receive an SMS confirming the transaction.

The agent will then give you the cash and request you to sign a Log Book which is a record of M-PESA transactions done in that store.

If You Are a Non-Registered Customer

Go to an M-PESA Agent and:

• Confirm the agent has sufficient funds for your transaction.

• Present the SMS containing the M-PESA voucher number (notification confirming receipt of cash).

• Give your phone number and show original ID.

• The agent will enter the ‘one time code’ that is displayed on the customer’s SMS notification.

• Both the agent and the customer will receive an SMS confirming the transaction.

• The agent will give you your money and request you to sign the Log book which is a record of M-PESA transactions done in that store.

When you send money to an unregistered customer, they will receive a one-time voucher from M-PESA with a 4 digit code which they will use to withdraw money from an agent. If SMS is not received or accidentally deleted, ask them to call line 234 and request for voucher to be resent to them.

ATM Withdrawal Service

ATM withdrawal service is available to M-PESA registered customers and is currently available at PesaPoint, Equity Bank Branches, Diamond Trust Bank, KCB, Family Bank and NIC Bank ATM’s.

To withdraw cash you will need to follow these instructions:

First on your phone:

• Select ‘Withdraw Cash’ from the M-PESA menu

• Select ‘From ATM’

• Enter Agent Number which is 555555 if you’re withdrawing from these ATMs: Pesapoint, Diamond Trust Bank, KCB, CFC Stanbic Family Bank and NIC Bank and if you’re withdrawing from Equity Bank ATM use the Agent Number 286286

• Enter your M-PESA PIN

You will receive an SMS notification from M-PESA with a 6-digit authorization code. (The code expires after 10 minutes and you will be expected to initiate the transaction afresh if you need to withdraw money again.)

Then on the ATM:

• Select the M-PESA button on the PesaPoint, Equity Bank, Diamond Trust Bank, KCB,CFC Stanbic, Family Bank, NIC Bank ATM

• Select your preferred language

• Enter the 6-digit ATM Authorization Code on the ATM keyboard.

• Enter your Safaricom mobile number.

• Enter the amount you wish to withdraw, press CONTINUE to proceed with transaction.

• ATM will dispense your cash and issue you with a receipt. You will also receive an SMS from M-PESA confirming the transaction.

How to Register for M-PESA

Learn how to Register for M-PESA. One can register for your M-PESA account for FREE at any of our authorized M-PESA agents countrywide.

Need to register your simcard, go to an authorized M-PESA Agent and:

Step 1: Replace Your Old Safaricom SIM Card

If you have an old Safaricom Sim with no M-PESA menu, upgrade the Safaricom SIM card at a fee of KSh 50. Its not necessary if it has M-PESA menu

NB: You will only be required to replace your SIM card if you have the old Safaricom SIM (black or light green in colour) which does not have the ‘Safaricom’ item under the menu. If you have the new generation SIM card (deep green in colour), registration will be done immediately.

The M-PESA agent will copy your SIM card contacts to the new SIM before proceeding with the replacement.

Step 2: Register as New M-PESA Customer

Register for M-PESA for FREE: You will be required to provide:

• Your Safaricom mobile number

• Your first and last name

• An original identification document

• Your date of birth

To register for M-PESA, you will be required to present one of the following original identification documents:

• Kenyan National ID

• Passport, Military ID

• Diplomatic ID

• Alien ID

You will be asked to attach a copy of your ID to your registration form* if you intend to receive more than KSh 100,000 into your M-PESA account per calendar year (January – December).

*copies of identification documents will be forwarded to Safaricom for record keeping.

Step 3: Activate Your M-PESA Account

M-PESA will send you and the Agent an SMS confirming that the registration has been successful. Activate your M-PESA menu on your account using the ‘4-digit Start Key’ sent to you by M-PESA as per the following instructions:

• Go to Safaricom menu and select M-PESA

• Select ‘Activate’ or ‘Wezesha’

• Enter the ‘Start Key’ (4-digit number received from M-PESA)

• Create a new PIN (a preferred 4-digit number that will be your PIN)

• Confirm the PIN by entering the 4-digit number again

• Enter your ID number (same as the one the agent entered upon registration)

M-PESA will send a menu to your phone with a ‘Secret Word’, press OK on receipt.

If you do not receive a Start Key upon registration or accidentally delete your Start Key SMS:

• Call line 234, or go to any Safaricom Retail Shop and request for a new Start Key

• A new Start Key will be sent to you via SMS on your mobile number

• Activate your M-PESA account as per instructions above

M-PESA PIN

You require your M-PESA PIN to send or withdraw money from your account and while using the M-PESA menu on your Safaricom SIM. You must keep your PIN secret and should therefore choose a combination that is easy for you to remember, but difficult for others to guess.

Do not share your M-PESA PIN with anyone, not even Safaricom staff. You can change your PIN at anytime from the M-PESA menu on your phone. You will be charged a fee of KSh 22 each time you change your PIN.

M-PESA Secret Word

You will receive a ‘Secret Word’ when you activate your M-PESA account. You are required to present this Secret Word to identify yourself when calling the M-PESA Customer Support (line 234).

Do not share your Secret Word with anyone other than Safaricom Customer Support Staff.

You can change your Secret Word to a word that is more memorable to you, by choosing ‘Secret Word’ under ‘My Account’ on the M-PESA menu, at any time free of charge.

Requirements to register for M-PESA as a Customer

Requirements to register for M-PESA as a customer

When registering for M-PESA as a customer, you will be required to present one of the following original identification documents:

- Kenyan National ID

- Passport, Military ID

- Diplomatic ID

- Alien ID

How to send money on M-pesa

How to send money on M-pesa. You can send or transfer money to any other mobile phone user, even if they are not a Safaricom subscriber. To send money you must first deposit cash into your own M-PESA account.

To send money;

- Go to the ‘Safaricom’ menu

- Select ‘M-PESA’

- Select ‘Send Money’.

- Enter your recipient’s phone number

- Enter the amount you wish to send

- Enter your PIN.

- You will receive a screen with the information you have entered above, (e.g., Send money to 0721 234569, KSh 3000) confirm that it is correct then Press Ok.

- A pop up with the name of the recipient will appear on the screen. Remember to confirm the name of the recipient .

- If the details are not correct, to stop a wrong transaction, type 1 and press send within 15 seconds

Hakikisha service enables you to confirm the name of the intended recipient of the funds, before completing an M-PESA transaction

You and the recipient will receive an SMS confirming the transaction.

If you send money to the wrong number:

• Funds sent to a wrong number will be reversed only if still available in the wrong recipient’s account.

• If successful, you will receive an SMS indicating that a reversal has been done.

Betty is a qualified teacher with a Bachelor of Education (Arts). In addition, she is a registered Certified Public Accountant. She has been teaching and offering part-time accounting services for the last 10 years. She is passionate about education, accounting, writing, and traveling.